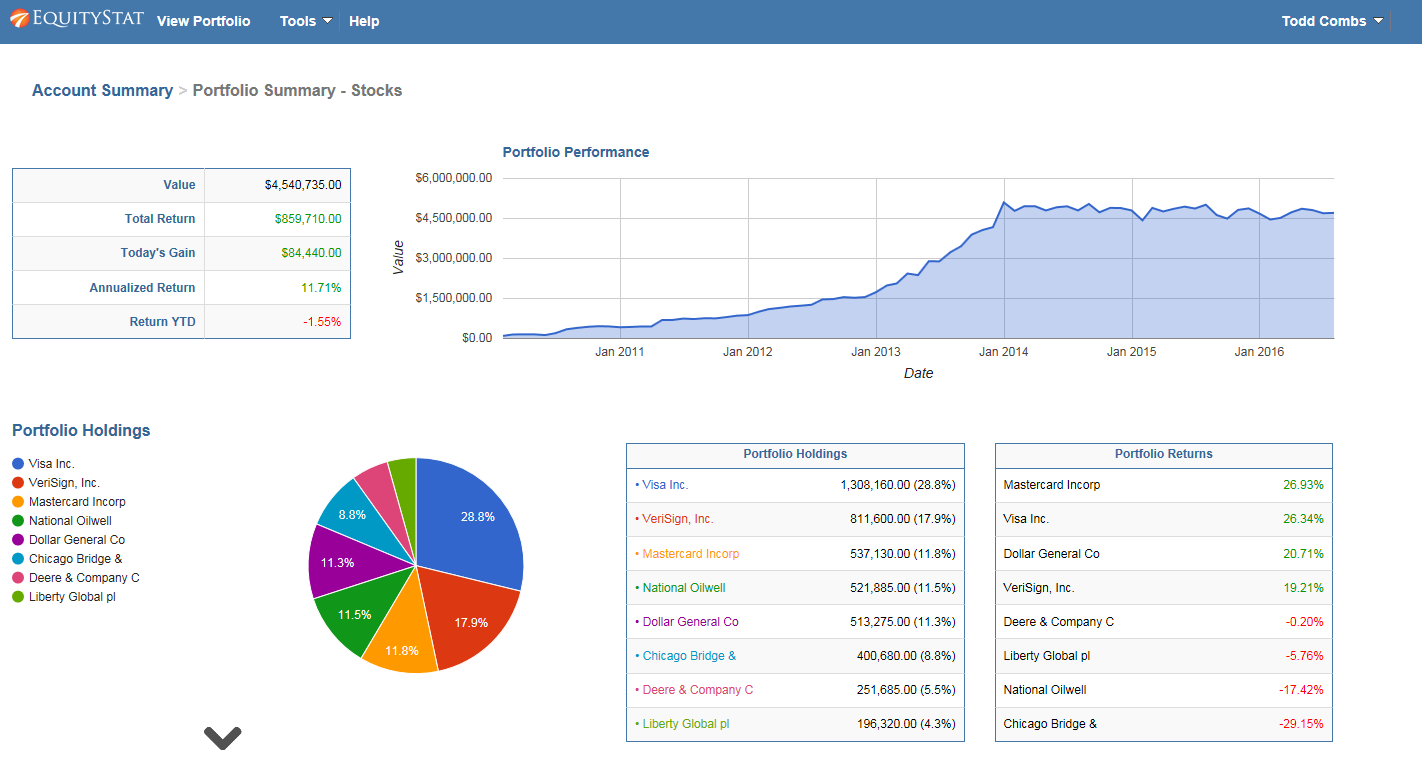

It’s that dreaded time of year – tax time. EquityStat’s portfolio manager has several tools to help investors with their taxes.

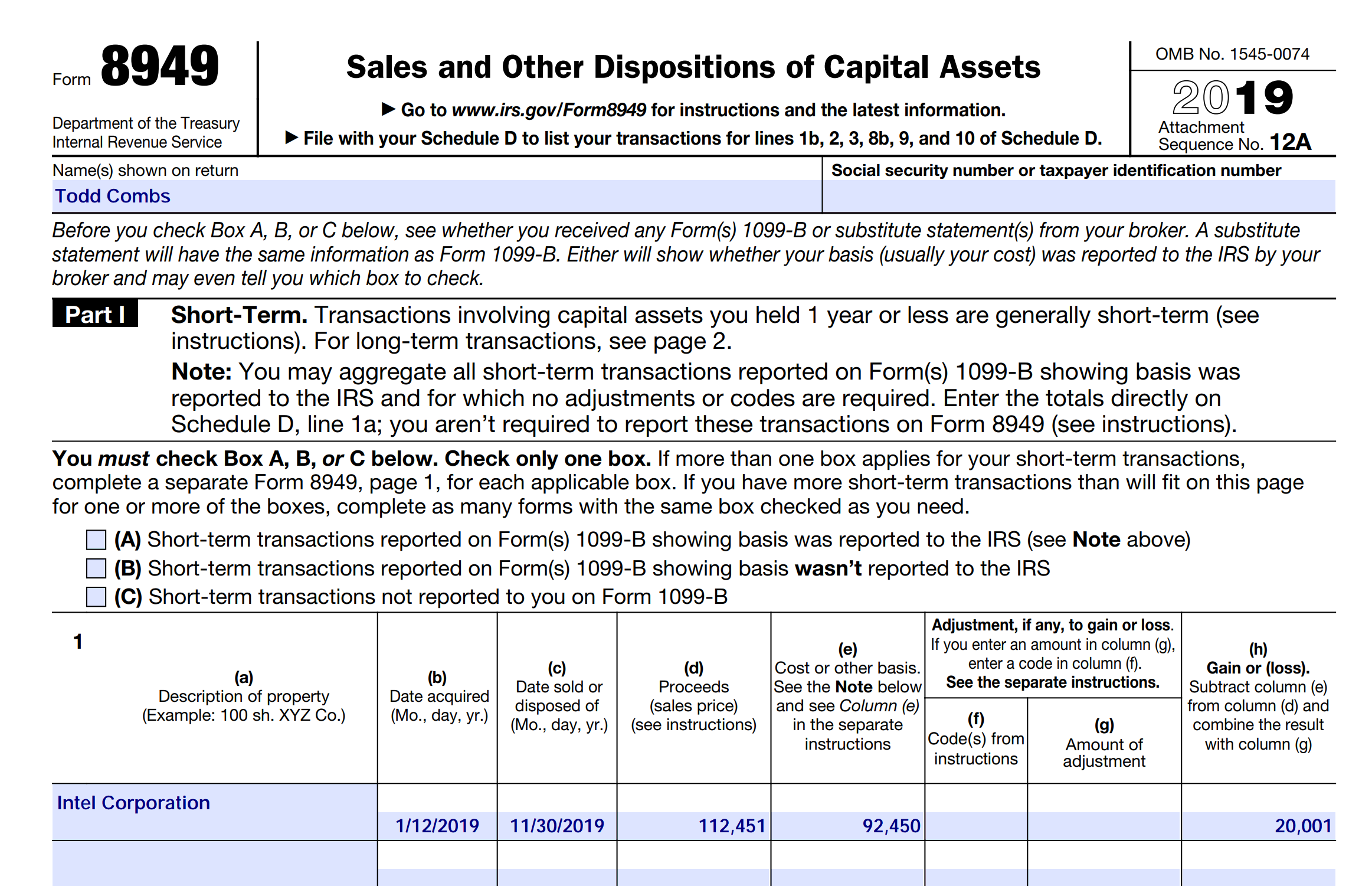

If you sold any shares last year, you can use EquityStat to generate IRS Form 8949. IRS Form 8949 is a form that shows your short-term and long-term capital gains on any investment sale. EquityStat will automatically calculate these capital gains. It will then generate a PDF of Form 8949 with all needed information that the IRS requires. You can then give this form to your tax preparer when you are preparing your taxes. To generate IRS Form 8949, click the Tools menu and then choose the Generate Form 8949 menuitem.

Another tool to help you with your taxes is the ability to export your investment’s transactions to a spreadsheet. To export your transactions, click the Tools menu and then choose the Export Transactions menuitem. When you export your transactions, you will get a spreadsheet showing each transaction for the investment including the type of transaction it is (e.g. Buy, Sell, Dividend, etc). With this information, your tax preparer can calculate your taxable capital-gains and taxable dividends for all of your investments.