If you own mutual funds why do you need a portfolio manager? Why can’t you just use the tools your mutual fund provides?

Transaction History

Many mutual funds do not provide all of your transaction history. They may provide up to 3 years of history but if you have owned your mutual fund longer than this, you do not have access to every transaction you have made.

Why is transaction history important? One, you need a complete transaction history for tax purposes if you sell shares in your mutual fund. Whenever you sell shares in a mutual fund you need to report to the IRS you gain or loss from to the sale. Without a complete transaction history you cannot accurately report the gain or loss, which may effect your taxes.

You also want a complete transaction history so that you can track your mutual fund’s performance over the history of the investment, not just over a limited time.

Performance Evaluation

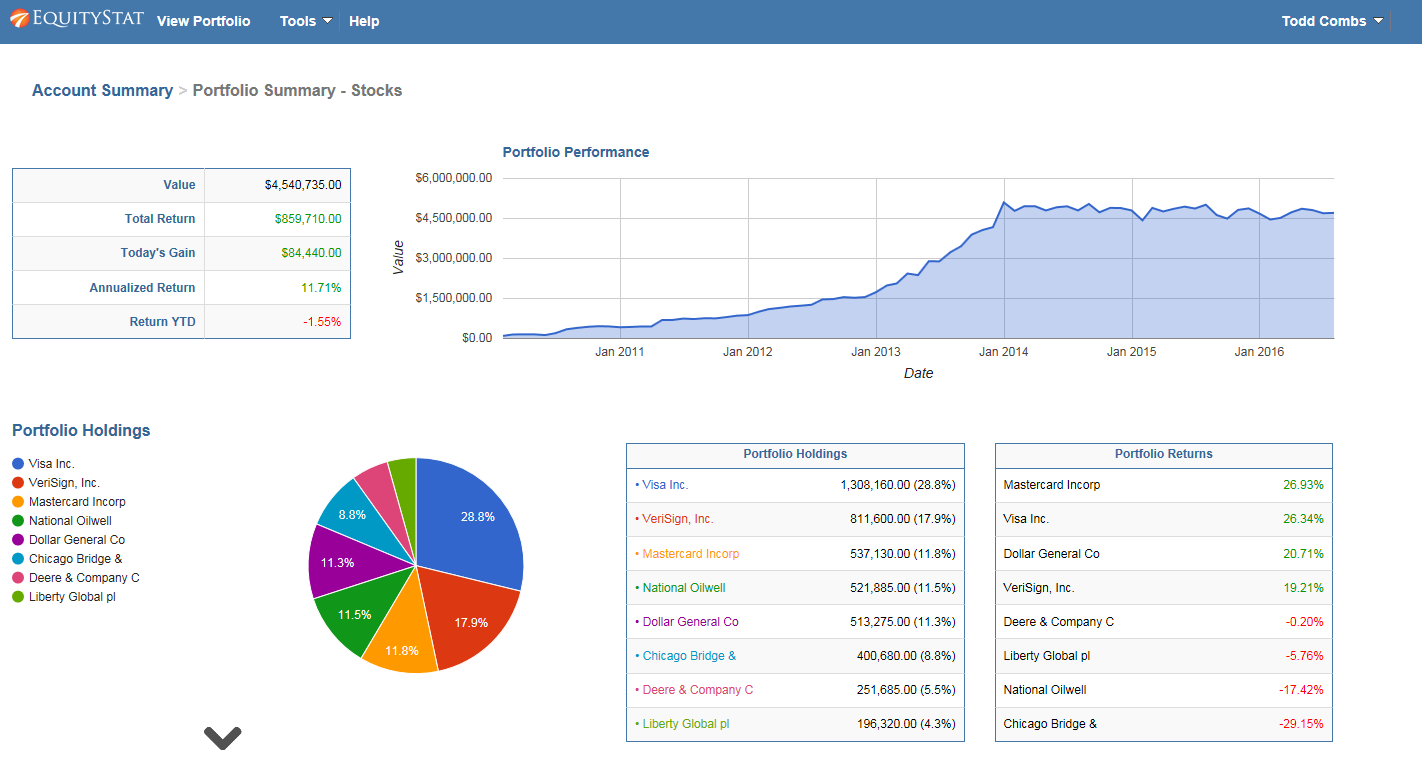

Many mutual funds will provide you the yearly return of the mutual fund but this may not be the return your investment has made. For example, say you own the hypothetical mutual fund XRXRXR. Let’s say XRXRXR price on January 1 is $100 a share and on December 31 it is $110 a share. The mutual fund will report their yearly gain as 10%. However, this does not take into account when you bought your shares. Let’s say that on July 1 you buy shares at $90 a share. Based on a closing price of $110/share, your gain is 22% and not 10%. Or, let’s say you bought your shares at $120 a share. Based on a closing price of $110/share, your loss is 8% and not a 10% gain. If you rely on your mutual fund’s performance return it could be less or more than what you are actually earning.

EquityStat

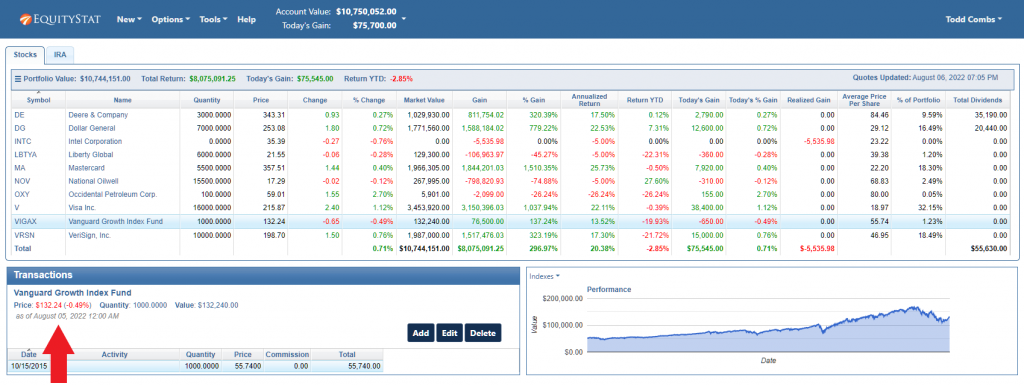

With EquityStat you can view the complete history of your transactions. In addition EquityStat gives you the ability to generate IRS form 8949 which will calculate any gains or losses on the sale of your mutual fund shares.

EquityStat will also calculate the annualized return on all of your investments. This calculation is based on when you purchased and sold your shares, not what the mutual fund reports their return is.