Do you have a lot of transactions that you need to import into EquityStat that you don’t want to manually enter? If so then you can use EquityStat’s import feature to import these transactions.

To import your transactions first get these transactions into a CSV (comma separated variable) file. The easiest way to generate a CSV file is to use Excel or any other spreadsheet application. With Excel you can enter your data into a spreadsheet and then save the file as a CSV file.

The CSV file must be in a certain format for you to import your transactions into your portfolio. The first line in the file must identify what each column is. The following column indentifiers are valid – Symbol, Date, TranType, Quantity, Price, Amount, Commission.

The valid values for the TranType column are Buy, Sell, Div, Rediv (Re-invested Dividend), Longcg (Long-Term Capital Gain), Shortcg (Short-Term Capital Gain), Relongcg (Re-Invest Long Term Capital Gain), Reshortcg (Re-Invest Short Term Capital Gain).

If you have a TranType value of Div then you will need an Amount column and you will not need the Quantity and Price column. If you have a TranType value of something other than a non re-invested dividend or non re-invested capital gain, you will need a Quantity and Price column. All rows must have a Symbol and Date column.

Here is a screen shot of a sample Excel file in the proper format.

Once you have your data entered in your spreadsheet, save it as a CSV file.

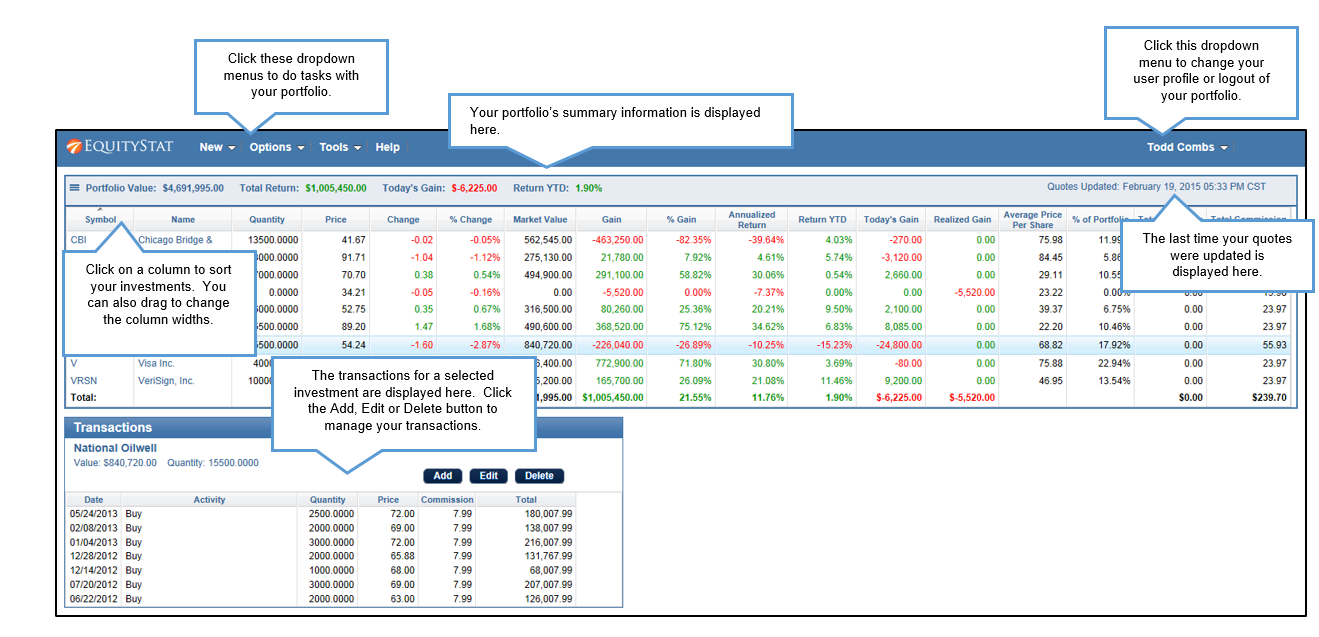

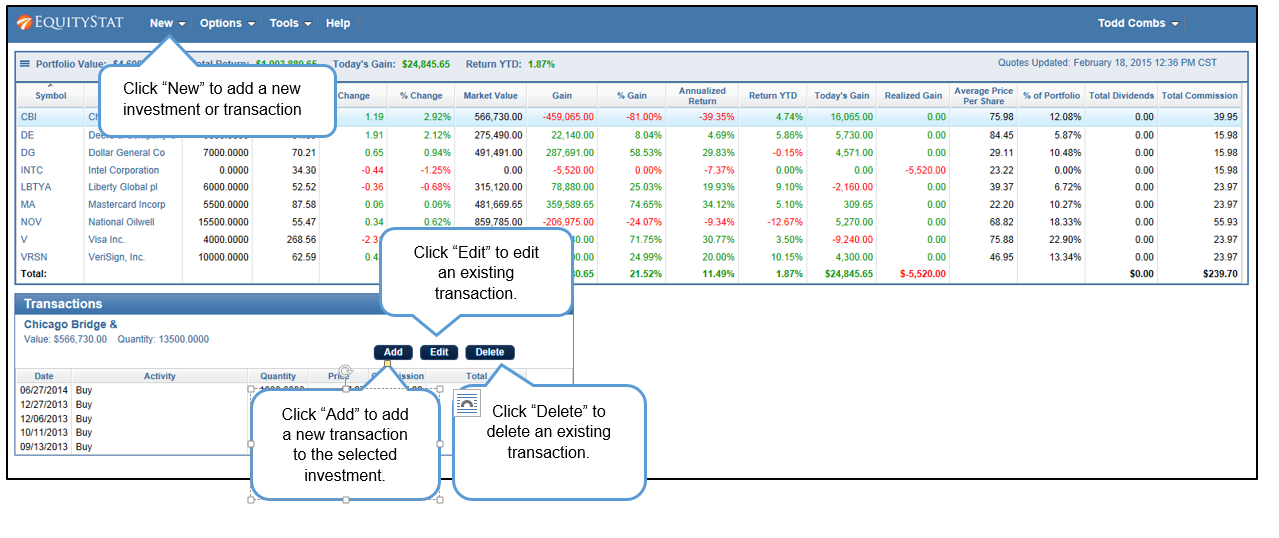

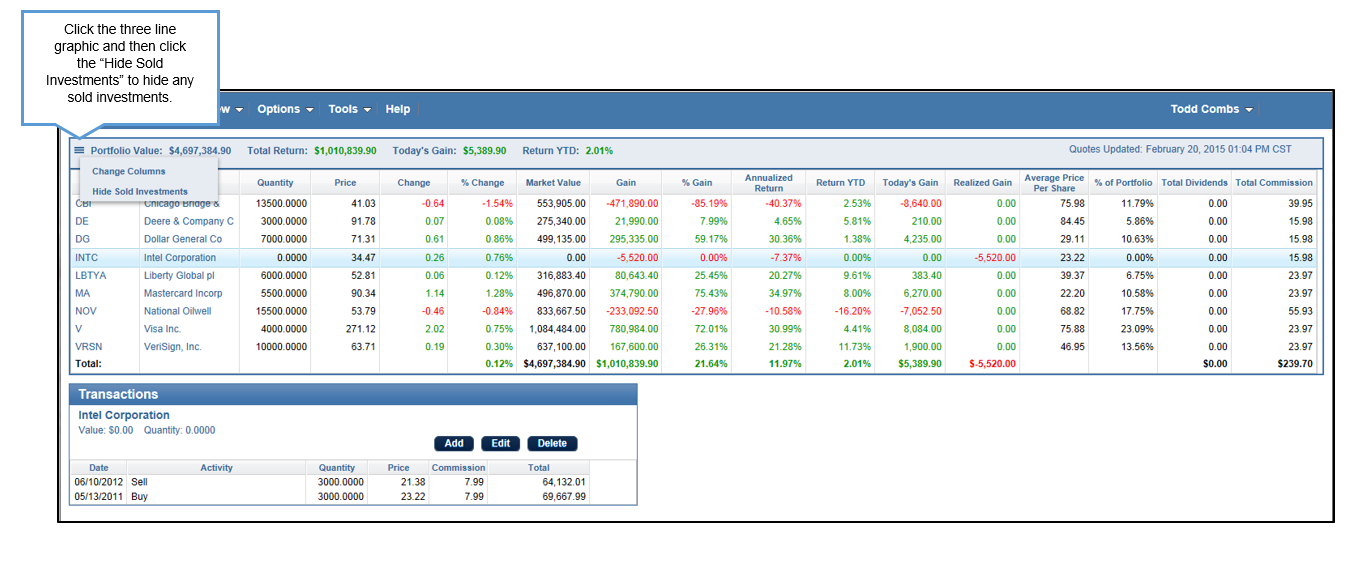

Next, login to your portfolio and click the New menu and choose Import Transactions. Then from the Import page, upload your CSV file from your computer. The transactions that will be imported will then be displayed. If everything is correct, continue the import process.

If you have any questions with how to do an import, feel free to contact our support desk by clicking the Help link from our home page.