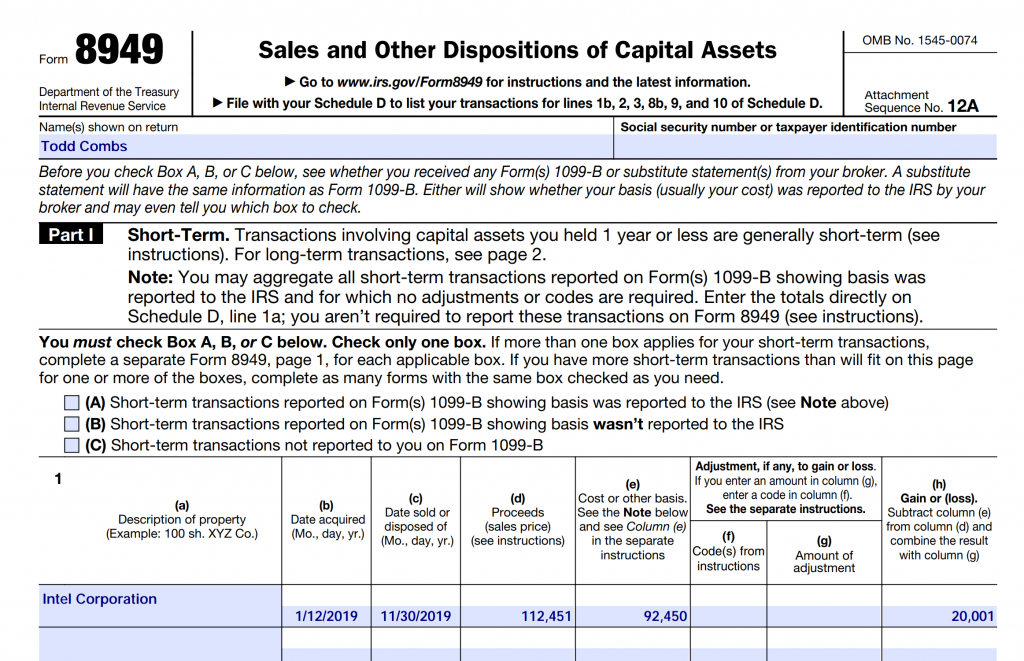

We just released the 2022 8949 IRS tax form. IRS Form 8949 is a form that reports your short and long term gains/losses for any sold investments in the tax year. If you had any investment sales in 2022, this form is a great way to easily calculate your losses/gains from this investment sale.

To generate Form 8949 click the Tools menu and choose the “Generate Form 8949” menuitem. On the “Generate Form 8949” page, click the Generate button. Your short-term and long-term gains/losses on any investment sales will then be calculated. Then a pdf format of IRS Form 8949 will be generated. This form has a short-term gains/losses section and long-term gains/losses section, which is what you need when filing your taxes.

Once this pdf form is generated, you can then send this pdf file to your tax preparer or print a copy of it.